Workers’ Compensation Solutions Through The Payroll Shoppe

Workers’ compensation is complicated. Although it’s not a mission-critical task to fulfill your company’s daily responsibilities, it’s critical to regularly pay your workers’ compensation premiums to protect your business.

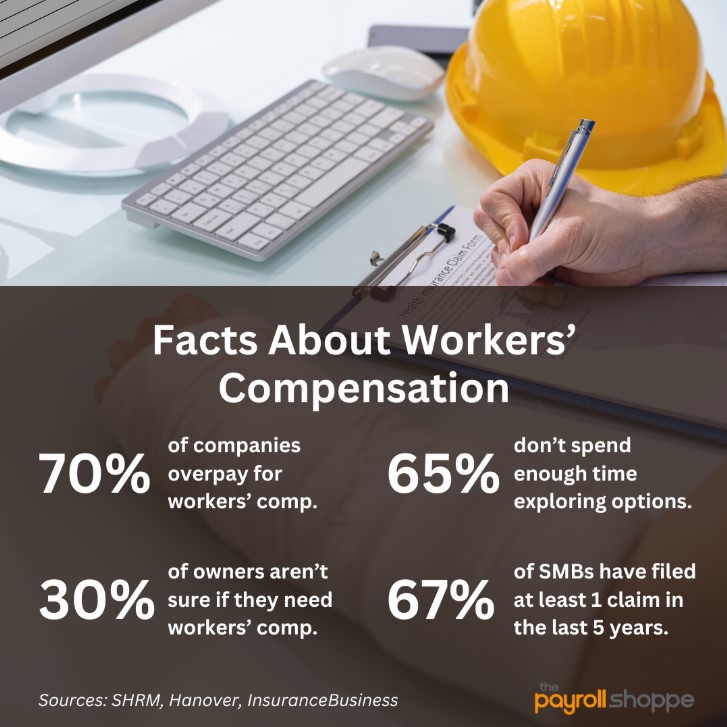

Still, concerns and confusion run rampant. Recent research shows:

- 70% of companies overpay on workers’ compensation. (Source: SHRM)

- 65% don’t believe they spend sufficient time exploring their insurance options. (Source: Hanover)

- 30% of small business owners aren’t sure if they need to purchase workers’ compensation coverage. (Source: InsuranceBusiness)

67% of small businesses have had at least one claim in the past five years. (Source: Hanover)

1. Trusted Partners

When you work through us, you’ll find excellent workers’ compensation coverage, pricing, and service from vendors who partner with The Payroll Shoppe.

Don’t worry about shopping around and taking a risk on a company you’ve never worked with before; rely on our network instead.

2. Payment Flexibility

Our vendors offer two different payment options:

- An annually set premium based on your previous year’s payrolls.

- A pay-as-you-go option that adjusts throughout the year based on your company’s growth.

These each have their own pros and cons. With the annually set premium, you can lock into a single rate throughout the calendar year, allowing you to better budget for workers’ compensation.

While that’s a desirable perk, not everyone loves it. One of the biggest complaints business owners have about this is the potential for sudden catch-up bills meant to compensate for retroactive coverage identified during the annual workers’ compensation audit.

These sudden, unexpected invoices can total thousands of dollars, serving a sizable hit to company cash flow.

But one of our partners overcomes this headache with a pay-as-you-go model. With every payroll that reflects a shift in your hiring history, your premium automatically adjusts.

This holds three major benefits:

- You can avoid those ugly year-end invoices.

- You can smooth out those large invoices into multiple payments throughout the year (inside your monthly premiums).

- You can better manage cashflow. No large, unexpected payments means you can better manage your finances all year long.

3. Hands-Off Coverage

Our dedicated team interacts with your insurance company and agent on your behalf, so you can focus on running your business and not on the intricate nuances of workers’ compensation.

Conquer Workers’ Compensation With The Payroll Shoppe

Overcome your workers’ compensation struggles with your team at The Payroll Shoppe. Contact us today to get started!

Switch to Us Today

To get started in working with our team, contact us. Our team is standing by and ready to help eliminate your payroll headaches through streamlined, stress-free payroll!